Two Sigma lmpact combines active.principled ownership and data sciencewith the goal of achieving superior returnsand positive social outcomes. We are focused on workforce impact -where we anticipate innovative andthoughtful investments in humans will leadto an enhanced employee experience,productivity and long-term financialreturns.

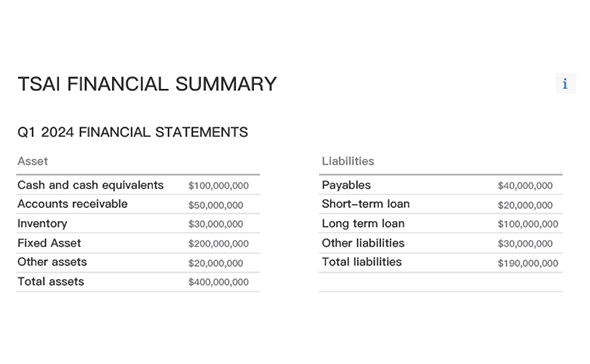

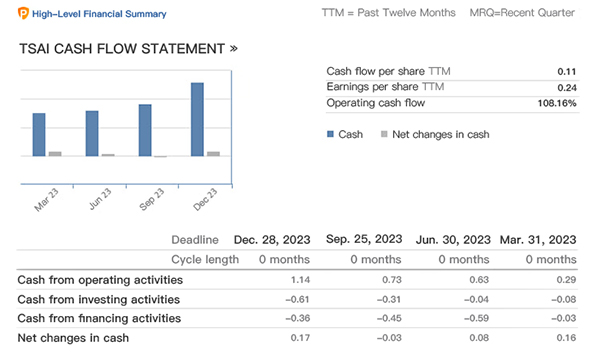

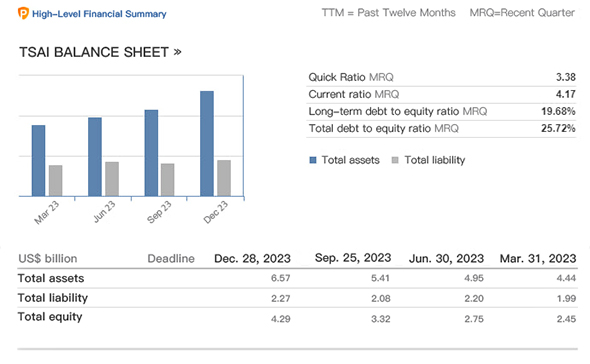

This is Financial

about Two Sigma

Our scientists bring rigorous exploration, data analysis, and invention to help solve the most severe challenges in the financial services field.

-

About Us

-

Our Philosophy

Technology and automation are incrediblypowerful tools that play a key role in thefuture of work, but as capital continues tobe invested in technology-and data-driven businesses, relatively lessinvestment is being made in buildingcompanies that depend more heavily onhuman capital. That's where we seeopportunity. For almost two decades, Two Sigma hasapplied technology, data science, andhuman invention to solve difficultproblems across financial services. Weapply those resources, along with arigorous, scientific mindset, to maximizeleadership teams" ability to achieve betterbusiness outcomes and create meaningfulwork for more people.

TSAI Intelligent Supercomputing Robot

TSAI Intelligent Strategy Trading Platform

AI robots that are more intelligent, have growth potential, can handle independently, and have diverse analytical logic have become the most novel and popular new type of trading strategy robot in the current era. At the same time, TSAI has also added a strategy analysis structure for cryptocurrencies and created a diversified and composite data analysis computer.

Analyst team

Our team

Composed of a group of experienced professionals with a deep background in the financial field. Most of their members have worked in the analysis department of Two Sigma, accumulating rich experience in quantitative financial analysis.

Andreas Kovacs

Chief Strategy Analyst

Ahmed Ali

Senior Strategy Analyst

Rudolf Schmidt

Strategic analystGlobal data becomes simple

Indisputable research

Most quantitative analysts spend 80% of their time organizing data, and only 20% of their time on research. TSAI puts rich global market data at your fingertips so you can focus on analysis.

-

Which sectors have the worst average EPS?

>>> prices = get_prices('us-stk-1d').loc["Close"]

>>> sectors = get_securities_reindexed_like(prices, fields=["Sector"]).loc["Sector"]

>>> eps = get_sharadar_fundamentals_reindexed_like(prices, fields=["EPS"]).loc["EPS"]

>>> eps.groupby(sectors).mean() -

Which penny stocks have the highest borrow fees?

>>> prices = get_prices("us-stk-1d").loc["Close"]

>>> borrow_fees = get_ibkr_borrow_fees_reindexed_like(prices)

>>> borrow_fees.where(prices < 1).rank(axis=1)

Real time transactions

Connect from anywhere